Straying Customers Costing You Sales? Here are 3 Ways Web Intent Data Helps You Retain Customers and Save Money

How Do I Win New Customers?

New customers are a nice confirmation of your marketing and an indication of a competitive product. Customer Acquisition (from the Latin "acquirere" meaning "to acquire") refers to all measures aimed at winning those customers.

In the past, Lead Generation was carried out through time-consuming cold calls or at cost-intensive trade fair booths. Today, you can reach potential customers at any point in their journey.

Data can be collected on potential customers while they're browsing, searching for, or comparing the types of products and services you sell. We call this Intent Data.

Audience Solutions allows you to use this data to connect with those people most interested in what you’re offering. Intent data is based on their demonstrated in-market behavior and intent.

Using proper customer acquisition strategies helps your company grow, and targeted customer acquisition programs help you cost-effectively win the right customers.

The last thing you want is to spend more money acquiring customers than your customers spend.

“Data-driven storytelling helps you meet your customer at every point along their customer journey. It helps you meet them at various touch points along the way, for example, when they are intending to make a purchase.” Andrews Wharton

How Much Does it Cost to Find a New Customer?

The cost of acquiring a new customer, or CAC, includes everything that goes into the mix. Time and money. Let’s say you spend $200,000 this year for your company operations and $100,000 on marketing. You win 100 new customers this year. Your CAC will be $300. Now you just need to ensure they spend more than $300.

Aside from proving the soundness of your business model, your CAC can also be used to analyze your marketing ROI. With that, you can optimize your campaigns.

Every dollar you don’t spend on marketing is another dollar you earn.

“A lot of companies focus on the old notion that it costs 5x more to get a new customer, but in doing so, they lose focus on what really matters—connecting with customers and delivering value - now and in the future.” Forbes

What is the Average Customer Acquisition Cost?

How much does a new customer cost the average company? 5:1 seems to be the industry average depending on which study you read. For your size and industry, you may be spending a little or a lot to acquire customers.

Higher Education and Real Estate are two industries that have very high average CACs. Online freelancers have very low CACs. Amazon and eBay have CACs somewhere between $120 to $160. There is no “one size fits all” CAC.

Recruiting an undergraduate student can cost a school more than $2,000 for each freshie. Think about finding a buyer -- a customer -- for your house. If your house sells for $300,000, you are probably paying a standard 5% commission. That means your CAC, for the sale of your house, is $15,000.

According to Shopify, the CAC of their customers is $58.64. That may seem a bit on the low end for your industry, however. It’s an average for eCommerce companies, and many of these have low overhead and few employees.

Business Wire reported that Finance apps from North America spent $985 Million on User Acquisition in 2020, with Q1 2021 already at $1.2 Billion Globally. That’s just in the FinTech sector.

What is the Impact of Losing a Customer?

Businesses make between 60% and 70% of their sales to existing customers. That’s all we need to know.

Let’s suppose you spend $300 to acquire a new customer and they spend $500. You have made $200. Ideally, your customer lifetime value (CLV`or sometimes called LTV) to CAC ratio should be higher. You should be looking at a ratio of 3:1.

$300 may not seem like a big number, but if you have a revolving door of incoming and outgoing customers, that number will increase – as will the time invested in customer acquisition.

3 New Customers vs 1 Retained Customer Over 3 Years

Year 1: CAC $300 Sales $500 CLV $200 Year 1: CAC $300 Sales $500 CLV $200

Year 2: CAC $300 Sales $400 CLV $100 Year 2: Sales $400 CLV $600

Year 3: CAC $300 Sales $300 CLV $0 Year 3: Sales $300 CLV $900

3 Customers. Total Revenue: $300 1 Customer. Total Revenue: $900

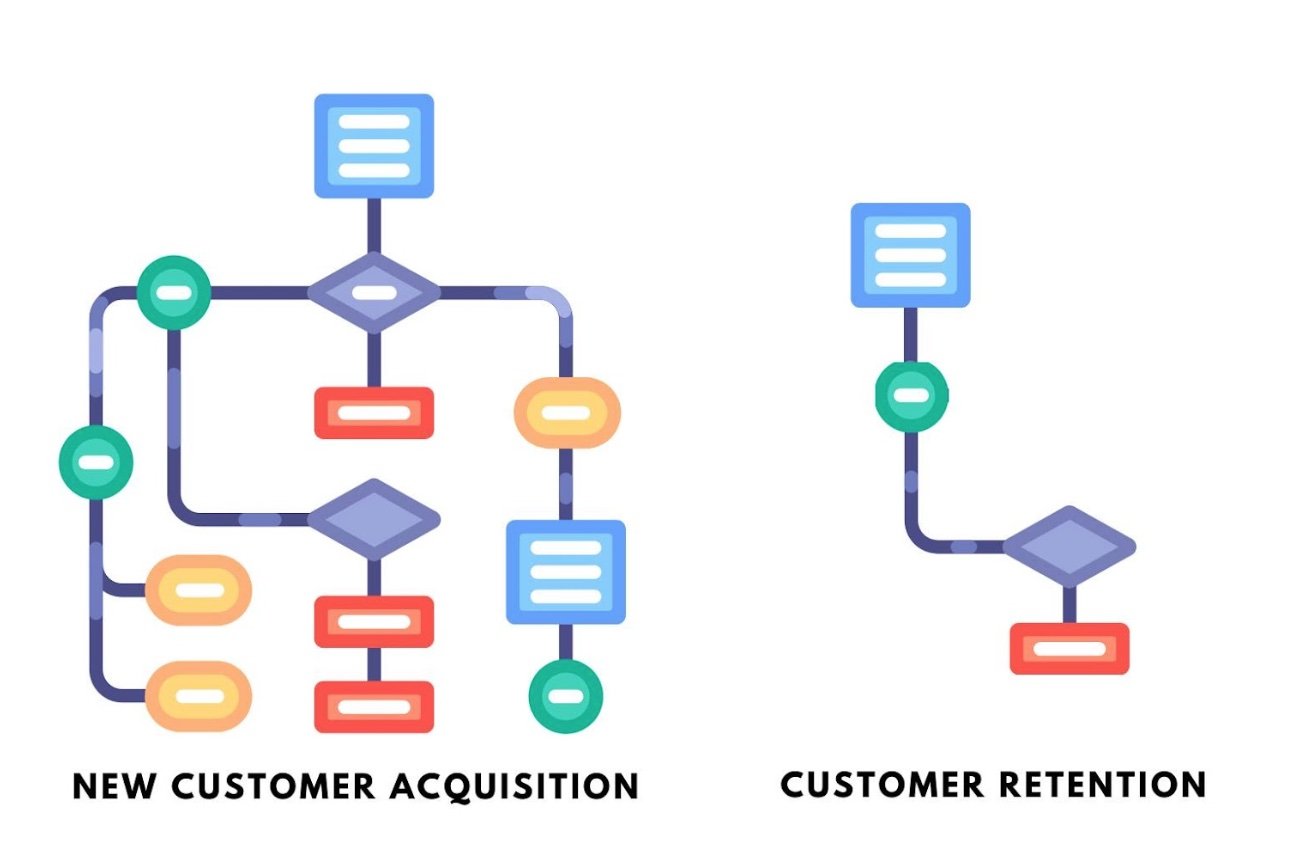

Simply put: If acquiring a customer is five times more expensive than retaining a customer, then the inverse is true: keeping customers is 5x cheaper than acquiring new customers.

“In financial services, a 5% increase in customer retention produces more than a 25% increase in profit. Why? Return customers tend to buy more from a company over time.” Bain & Company

Retaining customers is so much easier than acquiring new ones

Why is Customer Retention so Important?

Given new business models and competitors, the issue of customer loyalty is becoming increasingly important for everyone: this is where the key to more growth and success lies.

"Satisfied customers return." This rule of thumb has not only always been true in traditional retail -- but its accuracy for online businesses is growing.

The advantage of long-term customer loyalty is obvious: If you succeed in turning one-time buyers into regular customers, your business is more likely to hold its own in the market. After all, customers are the key to a company's success and revenue.

Successful customer loyalty represents an essential building block in the success chain of customer relationship management or CRM.

Customer retention not only helps you keep revenues secure and reduce CACs. Happy customers also serve to:

increase customer profitability,

extend the duration of customer relationships,

improve customer recovery success, and

increase the proportion of a customer's purchasing power for a particular product group

“Companies that had successfully won back a customer followed a similar pattern. They identified the reasons for the initial dissolution, applied the right cost-benefit analysis, conducted an honest conversation with the customer, and accommodated their specific requirements.” Harvard Business Review

3 Ways You Can Use Intent Data to Keep Customers from Straying

Whether it be someone purchasing a car, a life insurance policy, or donating to your baseball team, people matter, after all, it’s their hard-earned money. Trust, motivation, and understanding are essential cornerstones to keeping anyone from leaving you.

Finding and winning new customers is most often our focus. However, existing customers should receive at least as much attention. Loyal, new purchases occur during the customer life cycle, and a much smaller marketing budget is needed for this.

Distinguish which customers are on their way out the door and re-capture these consumers before they leave with Web Intent Data.

Lead Gen: improving targeting for outbound sales efforts

Outbound sales normally have a low success rate. Why? It’s often hard to determine the right fit for your product and whether they’re in the market to make a purchase. In-market customers are your best customers.

Straying customers start with the ones that got away from you. Are you looking for insurance prospects searching the web for a great deal on a car, home, boat, and personal liability bundle? Then web intent data is going to help.

Existing Customers: turning a mere sale into a personalized moment

Intent Data is personalized data. Personalization remains critical to achieving customer loyalty and increasing customer lifetime value. Especially in the insurance and finance sectors. It’s the key to customers’ feeling valued and understood.

Intent data gives you the perfect opportunity to answer a customer’s specific needs -- even to upsell when the time is right. When people feel understood, they enjoy a better customer experience – they don’t stray! Intent Data can play an essential role in delivering that unforgettable experience.

Customer Retention: customer care by keeping an eye on your competitors

Data isn’t just something you collect from aggregated data streams. Data tells a story about your customers. What are they doing? Why are they deciding on a particular purchase?

If your customers are spending time on competitors’ websites, perhaps it’s time to reach out and find out what interests them so much. The best way to retain customers before they go to the competition is to engage with them before they stray.

“People who trust you are more generous and more forgiving of any minor hiccups that may occur. So make an effort to gain the trust of your donors. And do it again and again. For example, by publishing success stories, disclosing your figures, or having local celebrities stand up for you.” Andrews Wharton

Customer Retention Issues? You Can Be Certain that AWI Will Help.

If your company’s current efforts aren’t meeting your objectives, our custom solutions can change that. We’re confident that our team, with 300+ years of combined experience, is capable of creating a custom solution to achieve your goals.